The global proptech market has surged to an unprecedented $18.2 billion in 2023, marking a transformative shift in how real estate professionals leverage technology to optimize operations, enhance property management, and drive investment decisions. This explosive growth, projected to reach $86.5 billion by 2032 at a CAGR of 16.8%, reflects the industry’s rapid digital transformation and increasing adoption of AI, IoT, and blockchain solutions across the property sector.

As traditional real estate boundaries blur with technological innovation, proptech solutions are revolutionizing everything from construction management to tenant experience. Industry leaders are witnessing a significant shift from conventional property operations to data-driven, automated systems that promise enhanced efficiency and reduced operational costs. The convergence of smart building technology, digital twins, and advanced analytics is creating new market opportunities while reshaping traditional business models.

This comprehensive market analysis examines the key drivers propelling proptech’s exponential growth, emerging technology trends, and strategic implications for stakeholders across the real estate value chain. Understanding these market dynamics is crucial for industry professionals seeking to maintain competitive advantage in an increasingly digitized property landscape.

Global PropTech Market Size and Growth Trajectory

Regional Market Distribution

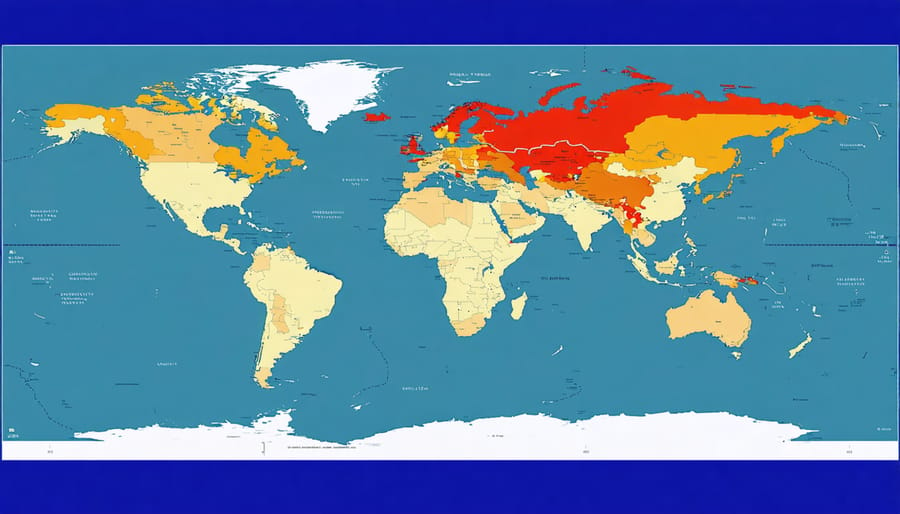

The PropTech market exhibits distinct regional patterns, with North America leading global adoption at approximately 35% market share. The United States and Canada demonstrate particularly strong growth in smart building technologies and property management solutions. Western Europe follows closely, accounting for 28% of the global market, with the UK and Germany emerging as innovation hubs for real estate technology.

The Asia-Pacific region represents the fastest-growing market, currently holding 25% of global share and projected to expand rapidly due to increasing urbanization and smart city initiatives. China and Singapore lead regional adoption, particularly in areas of artificial intelligence and IoT implementation for property management.

Latin America accounts for 7% of the market, with Brazil and Mexico showing significant potential for growth in property management platforms and digital transaction solutions. The Middle East and Africa region, while currently representing 5% of the market, is experiencing accelerated growth, particularly in the UAE and Saudi Arabia, where smart city developments are driving PropTech adoption.

This regional distribution reflects varying levels of technological infrastructure, regulatory environments, and market maturity across different geographical areas.

Investment Trends and Funding Landscape

The PropTech sector has witnessed unprecedented investment activity in recent years, with global venture capital funding reaching $32 billion in 2021, marking a 28% increase from the previous year. Leading venture capital firms have significantly increased their PropTech portfolios, recognizing the sector’s potential for digital transformation and innovation.

Mergers and acquisitions (M&A) activity has also accelerated, with established real estate companies acquiring innovative startups to enhance their technological capabilities. Notable transactions include property management platforms, smart building solutions providers, and digital transaction facilitators, with deal values ranging from $50 million to over $1 billion.

Early-stage funding remains robust, with seed and Series A rounds accounting for approximately 60% of total PropTech deals. Investment focus has shifted toward solutions addressing sustainability, energy efficiency, and building automation, reflecting growing environmental concerns and regulatory requirements.

Geographic distribution of investments shows North America leading with 45% of global PropTech funding, followed by Europe (30%) and Asia-Pacific (20%). Emerging markets are experiencing rapid growth in PropTech investments, particularly in regions with expanding urban populations and digital infrastructure development.

Corporate venture capital (CVC) participation has doubled since 2019, with real estate conglomerates and construction firms establishing dedicated innovation funds. This trend indicates growing recognition of PropTech’s strategic importance in transforming traditional real estate operations and construction processes.

Key PropTech Segments Driving Market Growth

Smart Building Technologies

The integration of smart building solutions represents one of the fastest-growing segments within the proptech market, with a current valuation of $82.3 billion in 2023. This sector is projected to reach $167.5 billion by 2027, driven by increasing demand for energy-efficient buildings and automated facility management systems.

IoT sensors and connected devices are leading this transformation, with an estimated 45% of commercial buildings expected to incorporate smart technologies by 2025. The market demonstrates particularly strong growth in automated HVAC systems, occupancy monitoring, and predictive maintenance solutions, which collectively account for approximately 60% of smart building investments.

Key growth drivers include regulatory pressure for energy efficiency, rising operational costs, and tenant demands for enhanced building experiences. Enterprise-scale deployments of smart building platforms have increased by 35% year-over-year, with major commercial real estate developers investing heavily in IoT infrastructure and building management systems. This trend is particularly evident in new construction projects, where integrated smart technologies are increasingly becoming standard rather than optional features.

Construction Technology Solutions

The construction technology solutions segment of the proptech market has experienced remarkable growth, driven by increasing demand for digital transformation in building processes. Recent market analysis indicates that construction management platforms and automation tools currently represent approximately $15.9 billion of the total proptech market value, with a projected CAGR of 14.2% through 2028.

Digital construction management solutions, including Building Information Modeling (BIM) platforms, project management software, and IoT-enabled equipment monitoring systems, account for 45% of this segment. These construction technology innovations are revolutionizing traditional building processes, reducing project timelines by up to 20% and cutting costs by 15-25% on average.

Automation tools, including robotics, prefabrication technologies, and AI-powered quality control systems, comprise 35% of the construction technology market. Leading contractors report that implementing these solutions has improved safety metrics by 30% and increased labor productivity by up to 50%.

The remaining 20% encompasses emerging technologies such as drone surveying, augmented reality for design visualization, and blockchain-based contract management systems. These solutions are gaining traction among forward-thinking construction firms, with adoption rates increasing by 65% year-over-year.

Market leaders like Procore, Autodesk, and Trimble continue to dominate the space, while innovative startups are rapidly introducing specialized solutions for niche construction applications. Industry experts predict that integration capabilities and data analytics features will become key differentiators as the market matures, with particular emphasis on sustainability monitoring and compliance tracking functionalities.

Market Challenges and Growth Barriers

Despite the proptech market’s rapid growth, several significant challenges and barriers continue to impact widespread adoption and market expansion. Integration difficulties with legacy systems remain a primary concern, as many established real estate and construction companies operate on outdated technological infrastructure that resists seamless implementation of new solutions.

Financial constraints pose another substantial barrier, particularly for small and medium-sized enterprises (SMEs). The initial investment required for comprehensive proptech solutions, including hardware, software, and staff training, often exceeds available budgets. This financial burden is compounded by the need for ongoing maintenance and updates.

Regulatory compliance and digital security challenges present significant hurdles for proptech adoption. As property technology becomes more sophisticated, companies must navigate complex data protection regulations while ensuring robust cybersecurity measures protect sensitive property and client information.

Industry resistance to change remains a persistent obstacle. Traditional real estate and construction professionals often exhibit skepticism toward new technologies, preferring established methodologies over innovative solutions. This cultural resistance significantly slows adoption rates and market penetration.

Technical expertise gaps within organizations create implementation challenges. Many companies lack personnel with the necessary skills to effectively deploy and manage advanced proptech solutions, leading to reduced ROI and decreased adoption rates.

Data standardization issues across different platforms and systems continue to hamper interoperability. The absence of universal standards for property data exchange and management creates integration difficulties and limits the effectiveness of proptech solutions across different stakeholders and platforms.

Market fragmentation also poses a significant challenge, with numerous vendors offering similar solutions without clear differentiation. This oversaturation can lead to decision paralysis among potential adopters and slower market growth as companies struggle to identify the most suitable solutions for their specific needs.

Future Market Outlook and Opportunities

Emerging Technologies Impact

Emerging technologies are fundamentally reshaping the proptech landscape, with artificial intelligence and machine learning leading the transformation. AI-powered solutions are revolutionizing property valuation, predictive maintenance, and tenant experience management, contributing significantly to market expansion. Industry analysts project that AI implementations in proptech will grow at a CAGR of 28% through 2027.

Blockchain technology is gaining traction in real estate transactions and property rights management, with smart contracts streamlining processes and reducing fraud risks. The technology’s market share in proptech is expected to reach $1.2 billion by 2025, reflecting growing adoption among industry stakeholders.

Internet of Things (IoT) integration has become crucial for smart building management, with connected devices and sensors driving operational efficiency. The IoT segment of proptech is projected to exceed $9.8 billion by 2026. Additionally, virtual and augmented reality technologies are transforming property showcasing and design visualization, with VR adoption rates increasing by 45% annually in the real estate sector.

5G connectivity and edge computing are enabling real-time data processing and advanced building automation, further accelerating market growth and innovation in the proptech sector.

The proptech market’s remarkable growth trajectory and expanding influence across the construction and real estate sectors signal a transformative period for industry stakeholders. With projected valuations reaching $86.5 billion by 2032 and a compound annual growth rate of 16.8%, the market presents substantial opportunities for innovation and investment. Key growth drivers, including digital transformation initiatives, sustainability requirements, and increasing demand for smart building solutions, will continue to shape the industry landscape.

For construction professionals and property developers, embracing proptech solutions is no longer optional but essential for maintaining competitive advantage. The integration of artificial intelligence, IoT devices, and data analytics platforms is revolutionizing project delivery, asset management, and operational efficiency. Industry leaders should focus on developing comprehensive digital strategies, investing in workforce training, and fostering partnerships with technology providers.

As we look ahead, the proptech sector’s evolution will significantly impact construction methodologies, property management practices, and investment decisions. Success in this rapidly evolving marketplace will depend on organizations’ ability to adapt to technological changes while maintaining focus on practical implementation and measurable returns on investment.