Decentralized cryptocurrency is transforming how construction companies handle payments, contracts, and project management across global supply chains. As blockchain technology in construction continues to mature, forward-thinking firms are leveraging digital assets to streamline cross-border transactions, automate supplier payments, and create immutable project records.

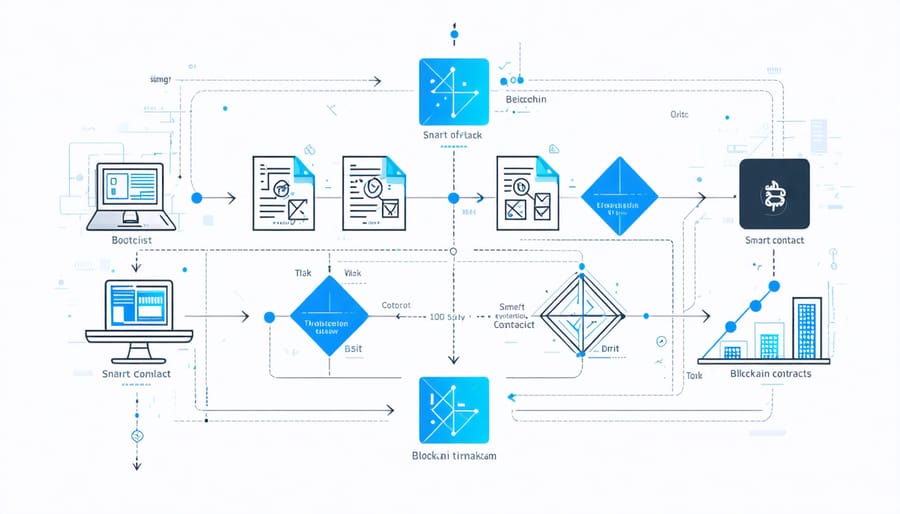

This shift represents a fundamental change in how construction projects manage financial operations. By eliminating intermediaries and reducing transaction costs, decentralized systems enable near-instantaneous settlements between contractors, suppliers, and clients. Smart contracts automatically execute payments when predefined milestones are met, ensuring transparent fund distribution while maintaining secure, tamper-proof documentation.

For construction executives and project managers, understanding decentralized cryptocurrency isn’t just about adopting new technology—it’s about gaining a competitive edge in an increasingly digital industry. From reducing payment delays to enhancing supply chain transparency, these solutions address longstanding challenges while opening new possibilities for efficiency and accountability in construction operations.

This article explores practical implementations, regulatory considerations, and proven strategies for integrating decentralized cryptocurrency into construction workflows, backed by real-world case studies from industry leaders who have successfully navigated this technological transition.

The Evolution of Construction Payment Systems

Traditional Payment Challenges

Traditional payment methods in construction projects face numerous challenges that impede efficiency and project flow. While the industry has been gradually revolutionizing payment systems, conventional approaches still present significant hurdles.

Payment delays remain a persistent issue, with contractors and subcontractors often waiting 60-90 days for invoice processing. This delay creates cash flow constraints that can impact material procurement and labor compensation. The complexity of payment chains in construction projects, involving multiple stakeholders, further compounds these challenges.

Traditional banking systems also impose substantial transaction fees and international payment restrictions, particularly problematic for global construction projects. Currency exchange rates and cross-border payment regulations can add significant costs and administrative burden.

Documentation requirements and manual verification processes contribute to payment bottlenecks. Purchase orders, change orders, and progress certificates must undergo multiple approval stages, leading to administrative overhead and increased potential for errors.

Moreover, dispute resolution in traditional payment systems can be time-consuming and costly, often resulting in project delays and strained business relationships.

Smart Contracts and Automated Payments

Smart contracts are revolutionizing payment processes in construction projects through blockchain technology. These self-executing contracts automatically facilitate, verify, and enforce payment terms when predetermined conditions are met. For example, when a building inspector confirms milestone completion through a digital verification system, the smart contract automatically releases the corresponding payment to contractors.

The automation eliminates payment delays and reduces administrative overhead traditionally associated with construction payments. Project stakeholders can track payment flows in real-time through an immutable distributed ledger, ensuring transparency and accountability. This system is particularly valuable for complex projects involving multiple subcontractors and suppliers.

Smart contracts can be programmed to include specific performance metrics, quality standards, and completion deadlines. When integrated with IoT sensors and digital documentation systems, these contracts can autonomously verify work completion and compliance with project specifications. This reduces payment disputes and accelerates the payment cycle.

Leading construction firms implementing smart contracts report significant reductions in payment processing times, from weeks to minutes, while maintaining comprehensive audit trails. The technology also enables innovative payment models, such as automated progress payments and performance-based incentives, fostering better collaboration among project stakeholders.

Implementing Decentralized Finance in Construction

Supply Chain Finance

Supply chain finance in construction is undergoing a revolutionary transformation through decentralized cryptocurrency solutions. By integrating blockchain technology with digital project management platforms, construction companies can now streamline supplier payments and material procurement processes with unprecedented efficiency and transparency.

Smart contracts automate payment releases based on predefined milestones, ensuring suppliers receive compensation promptly upon delivery verification. This system eliminates traditional payment delays and reduces the administrative burden of managing multiple vendor relationships. For instance, when materials arrive on-site and quality checks are completed, smart contracts automatically trigger cryptocurrency payments to suppliers, maintaining healthy cash flow throughout the supply chain.

The implementation of cryptocurrency-based supply chain finance offers several key advantages. First, it reduces transaction costs associated with international payments, particularly beneficial for projects sourcing materials globally. Second, the immutable nature of blockchain provides a transparent audit trail of all transactions, enhancing accountability and reducing disputes. Third, the use of stable coins pegged to traditional currencies helps mitigate cryptocurrency volatility risks while maintaining the benefits of blockchain technology.

Leading construction firms are already reporting significant improvements in supplier relationships and material procurement efficiency through cryptocurrency integration. One major contractor reduced payment processing time by 75% and achieved a 15% reduction in supply chain financing costs after implementing a blockchain-based payment system.

To successfully implement cryptocurrency in supply chain finance, construction companies should start with pilot programs involving key suppliers, gradually expanding the system as processes are refined and stakeholders become more comfortable with the technology.

Cross-border Transactions

Cross-border construction projects have long faced challenges with traditional payment systems, including high transaction fees, lengthy processing times, and currency exchange complications. Decentralized cryptocurrency offers a transformative solution to these pain points, enabling seamless international transactions and improved financial efficiency.

Construction companies engaging in multinational projects can leverage cryptocurrencies to facilitate instant payments to contractors, suppliers, and workers across different countries. This eliminates the need for intermediary banks and reduces transaction costs by up to 70% compared to conventional wire transfers. For instance, a Dubai-based developer working on a project in Singapore can execute payments to local subcontractors within minutes, regardless of time zones or banking hours.

Smart contracts on blockchain platforms further enhance cross-border transactions by automating payment releases based on predetermined project milestones. This ensures transparent and timely payments while reducing payment disputes and administrative overhead. Leading construction firms report significant improvements in cash flow management and vendor relationships after implementing cryptocurrency payment systems.

Currency volatility risks can be mitigated through stablecoins, which maintain a fixed value relative to fiat currencies. This provides construction businesses with the benefits of cryptocurrency transactions while maintaining price stability for budgeting and accounting purposes. Additionally, blockchain’s immutable ledger creates an audit trail for all international transactions, simplifying compliance with various regulatory requirements and tax jurisdictions.

Several major construction companies have already adopted cryptocurrency for their international operations, reporting reduced payment cycles from weeks to hours and achieving substantial cost savings in cross-border transactions. As the technology matures, experts predict widespread adoption across the global construction industry, particularly in regions with developing banking infrastructure.

Real-world Case Studies

Large-scale Infrastructure Project

The implementation of decentralized cryptocurrency in large-scale infrastructure projects has demonstrated significant potential for streamlining payment processes and enhancing project transparency. A notable example is the Dubai World Trade Center expansion project, which successfully integrated blockchain-based payment systems for contractor remuneration and material procurement.

The project utilized smart contracts to automate milestone-based payments, reducing payment processing time from an average of 45 days to just 72 hours. This system enabled real-time tracking of fund allocation across multiple subcontractors and suppliers, while maintaining an immutable record of all transactions.

Key benefits observed included a 30% reduction in administrative costs associated with payment processing, enhanced security through cryptographic verification, and improved cash flow management for all stakeholders. The system’s decentralized nature eliminated the need for traditional intermediaries, resulting in faster settlement times and reduced transaction fees.

However, implementation challenges required careful consideration. The project team invested significantly in training personnel and developing user-friendly interfaces for stakeholders unfamiliar with cryptocurrency transactions. Integration with existing enterprise resource planning (ERP) systems demanded custom solutions and rigorous testing protocols.

Risk mitigation strategies included implementing multi-signature authentication for large transactions, establishing cryptocurrency-to-fiat conversion corridors, and creating detailed audit trails for regulatory compliance. The success of this implementation has set a precedent for future infrastructure projects, demonstrating the practical viability of cryptocurrency solutions in construction finance management.

Multi-stakeholder Commercial Development

A recent case study of the Hudson Square Development Project demonstrates how decentralized payment systems can effectively manage complex stakeholder relationships in commercial construction. The project, involving multiple contractors, suppliers, and financial institutions, implemented a blockchain-based payment infrastructure that streamlined transactions among 47 different stakeholders.

The system utilized smart contracts to automate payment releases based on predefined milestones and verification protocols. This resulted in a 40% reduction in payment processing time and eliminated traditional intermediary fees. Notably, the project’s general contractor reported significant improvements in subcontractor satisfaction due to transparent payment tracking and near-instantaneous settlements.

Key success factors included:

– Implementation of multi-signature wallets requiring approval from multiple stakeholders

– Real-time verification of work completion through IoT sensors integrated with the payment system

– Automated compliance checking against contract terms

– Immutable record-keeping for audit purposes

However, challenges emerged during implementation, particularly regarding stakeholder education and initial resistance to technology adoption. The project team addressed these through comprehensive training programs and graduated implementation phases. The system’s resilience was tested when managing change orders, where smart contracts successfully automated payment adjustments based on scope modifications.

This case demonstrates that decentralized payment systems can effectively handle complex multi-stakeholder scenarios while maintaining transparency and reducing administrative overhead in commercial development projects.

Security and Regulatory Considerations

Risk Management Protocols

In the evolving landscape of construction finance, implementing robust digital security measures for cryptocurrency transactions is paramount. Construction firms must establish multi-signature wallet protocols requiring multiple authorized parties to approve transactions, thereby preventing unauthorized fund transfers and reducing fraud risks.

Smart contract auditing should be conducted by certified third-party organizations before implementation, ensuring code integrity and identifying potential vulnerabilities. Regular penetration testing of blockchain platforms and associated applications helps maintain system security and prevents potential breaches.

Key risk management protocols include:

– Implementation of cold storage solutions for storing large amounts of cryptocurrency

– Regular backup of private keys with encrypted redundancy

– Establishment of transaction limits and approval hierarchies

– Real-time monitoring systems for detecting suspicious activities

– Comprehensive staff training on cryptocurrency security best practices

Construction companies should maintain detailed transaction logs and implement automated reconciliation processes to ensure transparency and accuracy. Insurance coverage specifically designed for cryptocurrency holdings should be secured, protecting against potential losses from cyber attacks or technical failures.

Emergency response procedures must be documented and regularly updated, including protocols for immediate fund transfers to secure wallets in case of security breaches. These measures, combined with regular security audits, create a robust framework for managing cryptocurrency risks in construction operations.

Regulatory Framework

The regulatory landscape for cryptocurrency in construction continues to evolve, with various jurisdictions implementing different frameworks to govern digital asset transactions. In the United States, the Securities and Exchange Commission (SEC) and the Commodity Futures Trading Commission (CFTC) provide oversight for cryptocurrency operations, requiring construction companies to maintain detailed transaction records and comply with anti-money laundering (AML) regulations.

Construction firms implementing cryptocurrency payments must establish robust Know Your Customer (KYC) protocols and maintain compliance with the Bank Secrecy Act (BSA). This includes verifying the identity of all parties involved in cryptocurrency transactions and reporting any suspicious activities to relevant authorities.

International projects face additional complexity due to varying regulatory requirements across borders. The European Union’s Markets in Crypto-Assets (MiCA) regulation, for instance, provides a comprehensive framework that construction companies must navigate when operating within EU member states.

Tax implications remain a critical consideration, as cryptocurrency transactions must be properly documented and reported. Construction companies must maintain accurate records of cryptocurrency valuations at the time of transactions for tax purposes and capital gains calculations.

Smart contracts utilizing cryptocurrency must comply with both traditional construction contract laws and emerging digital asset regulations. Companies should work with legal experts familiar with both construction law and cryptocurrency regulations to ensure compliance while implementing decentralized payment solutions.

As the construction industry continues to evolve, decentralized cryptocurrency presents a transformative opportunity to revolutionize traditional business processes and financial transactions. The implementation of blockchain technology and cryptocurrency solutions has demonstrated significant potential in addressing long-standing challenges such as payment delays, contract disputes, and supply chain transparency.

The successful adoption of decentralized cryptocurrency in construction projects worldwide has shown remarkable improvements in payment efficiency, reducing processing times from weeks to minutes while significantly lowering transaction costs. Smart contracts have proven particularly valuable in automating payment processes and ensuring contractual compliance, leading to enhanced project delivery and stakeholder satisfaction.

Looking ahead, the integration of decentralized cryptocurrency in construction is expected to expand beyond simple transactions. Industry experts anticipate the development of more sophisticated applications, including tokenized real estate assets, decentralized project funding mechanisms, and blockchain-based building information modeling (BIM) systems. These innovations promise to create more efficient, transparent, and collaborative construction ecosystems.

However, successful implementation will require continued education, regulatory alignment, and industry-wide standardization. Construction companies that embrace these technologies early will likely gain significant competitive advantages, while those that delay may find themselves struggling to adapt to the new digital economy. As the technology matures and adoption increases, decentralized cryptocurrency is poised to become an integral part of the construction industry’s digital transformation, fundamentally changing how projects are funded, executed, and managed.