Project finance modeling revolutionizes how renewable energy initiatives transform from concept to reality, driving the $366 billion global renewable energy market while reshaping traditional financing energy efficiency projects. Advanced financial modeling techniques now enable stakeholders to precisely evaluate project viability, optimize capital structures, and mitigate risks across solar, wind, and other renewable installations.

Modern renewable project finance demands sophisticated modeling approaches that integrate multiple variables – from power purchase agreements and tax incentives to operational costs and weather-dependent revenue forecasts. Industry leaders leverage these models to secure funding, demonstrate project bankability, and ensure long-term sustainability of renewable investments.

This comprehensive analysis explores cutting-edge financial modeling methodologies specifically tailored for renewable energy projects, combining technical expertise with practical implementation strategies. Drawing from successful case studies and industry best practices, we examine how project finance modeling drives informed decision-making, maximizes returns, and accelerates the global transition to sustainable energy infrastructure.

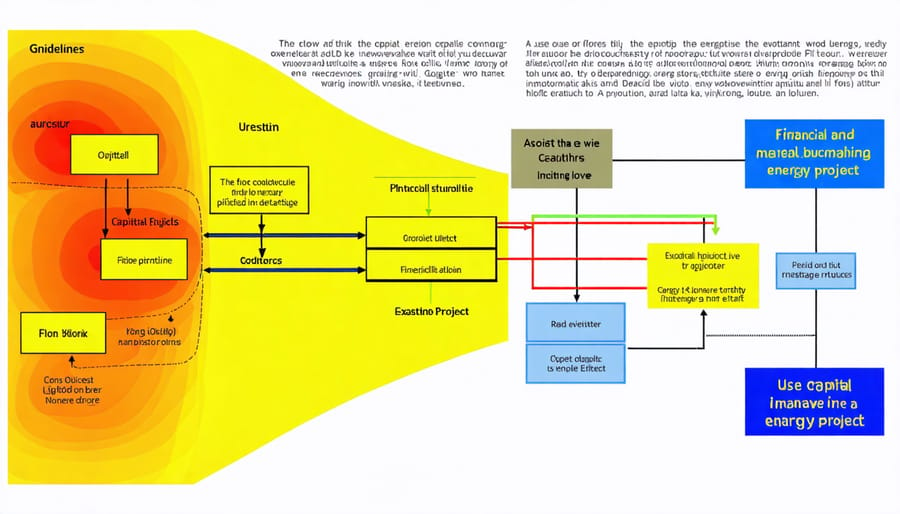

Core Financial Modeling Components for Renewable Projects

Capital Expenditure Forecasting

Capital expenditure (CAPEX) forecasting is a critical component in renewable energy project finance modeling, requiring detailed analysis of initial investment requirements and ongoing capital needs. For utility-scale solar and wind projects, accurate CAPEX estimation typically encompasses equipment costs, installation expenses, and infrastructure development.

The primary components of CAPEX in renewable energy projects include major equipment (such as solar panels, wind turbines, or energy storage systems), balance of plant costs, grid connection infrastructure, and land acquisition or lease expenses. Industry benchmarks suggest that equipment costs typically represent 40-60% of total CAPEX for solar projects and 65-85% for wind projects.

Cost estimation techniques commonly employ a combination of bottom-up and top-down approaches. The bottom-up method involves detailed itemization of individual components, while top-down analysis utilizes historical data and industry benchmarks to validate estimates. Leading firms often incorporate contingency factors ranging from 5-15% to account for potential cost overruns and unforeseen expenses.

Modern CAPEX forecasting increasingly relies on advanced modeling tools that consider regional variations, supply chain dynamics, and technological improvements. These tools often integrate machine learning algorithms to improve accuracy and account for market trends. For example, recent innovations in solar panel efficiency have led to reduced per-watt installation costs, necessitating regular updates to forecasting models.

Successful CAPEX forecasting requires close collaboration between technical teams and financial analysts to ensure assumptions align with project specifications and market realities.

Revenue Stream Modeling

Revenue stream modeling forms the backbone of any renewable energy project’s financial analysis, with Power Purchase Agreements (PPAs) typically serving as the primary income source. These long-term contracts establish guaranteed pricing structures and define the terms under which electricity will be sold, providing stable cash flow projections essential for investor confidence.

The modeling process must account for multiple revenue components, including direct electricity sales, renewable energy credits (RECs), and potential tax incentives. Energy production forecasts, based on resource assessment studies and equipment specifications, are crucial inputs that determine the projected annual revenue. These forecasts must incorporate seasonal variations, degradation factors, and system availability rates.

For commercial and industrial projects, energy savings calculations become particularly significant. These models compare baseline energy costs against projected renewable energy generation to demonstrate cost advantages. The analysis typically includes escalation rates for conventional electricity prices, which can significantly impact the project’s long-term value proposition.

Advanced revenue models also consider ancillary income streams such as capacity payments, frequency regulation services, and grid support mechanisms. These additional revenue sources can enhance project viability, particularly in markets with sophisticated grid service mechanisms.

Sensitivity analysis of revenue projections is essential, accounting for variables such as weather patterns, equipment performance, and market price fluctuations. This analysis helps stakeholders understand potential revenue variations and establish appropriate risk mitigation strategies.

Risk Assessment and Mitigation Strategies

Construction Risk Analysis

Construction risk analysis forms a critical component of project finance modeling in renewable energy projects, particularly given the substantial capital investment and complex implementation requirements. The assessment begins with a thorough evaluation of site-specific challenges, including geotechnical conditions, environmental factors, and accessibility considerations that could impact construction timelines and costs.

Key risk factors typically include equipment delivery delays, material price fluctuations, labor availability, and weather-related disruptions. These elements must be carefully quantified and incorporated into the financial model through contingency allocations and schedule buffers. Implementation of comprehensive risk mitigation strategies becomes essential to protect project viability and investor interests.

Construction contracts play a pivotal role in risk allocation, with Engineering, Procurement, and Construction (EPC) agreements often preferred for their fixed-price, date-certain completion guarantees. Performance bonds, liquidated damages clauses, and warranty provisions provide additional layers of protection against construction-related risks.

Project developers must also consider technology-specific challenges, such as foundation requirements for wind turbines or structural integrity for solar panel mounting systems. Environmental impact assessments and regulatory compliance requirements can significantly influence construction timelines and costs, necessitating careful integration into the financial model’s assumptions.

Insurance coverage represents another crucial aspect of risk management, with builders’ risk insurance, professional liability coverage, and performance bonds forming essential components of the risk mitigation framework. Regular monitoring and updating of risk assessments throughout the construction phase ensures the model remains responsive to emerging challenges and market conditions.

Performance Risk Management

Performance risk management in renewable energy projects centers on accurately predicting and guaranteeing energy generation outputs, which directly impact financial returns. Energy yield assessments (EYAs) form the foundation of performance forecasting, typically utilizing historical meteorological data, sophisticated modeling software, and site-specific factors to estimate production levels.

Project developers must account for various performance factors, including equipment degradation rates, system availability, and seasonal variations. Solar projects typically consider panel degradation of 0.5-0.7% annually, while wind projects must factor in wake effects and turbine availability rates of 95-98%.

Performance guarantees play a crucial role in risk mitigation, usually structured as availability guarantees or output guarantees. These contractual mechanisms ensure that equipment manufacturers and operators maintain specified performance levels, with liquidated damages provisions protecting investors against underperformance.

Key performance indicators (KPIs) should be carefully defined and monitored, including:

– Capacity factor

– Availability factor

– Performance ratio

– Energy yield

– System losses

Modern monitoring systems enable real-time performance tracking and early detection of issues. Machine learning algorithms increasingly help predict maintenance needs and optimize output, reducing unexpected downtime and performance losses.

Insurance products, such as performance ratio insurance and weather risk coverage, provide additional layers of protection. These instruments help secure project financing by offering compensation for generation shortfalls due to equipment failure or resource variability.

Financial models should incorporate conservative assumptions and appropriate contingencies, typically using P90 or P95 probability levels for energy production estimates to ensure bankability while maintaining realistic revenue projections.

Financial Structure Optimization

Debt-Equity Ratio Analysis

The debt-to-equity ratio plays a crucial role in determining the financial viability of renewable energy projects. Most successful renewable energy projects maintain a leverage ratio between 70:30 and 80:20, with debt typically comprising the larger portion of the capital structure. This high leverage is possible due to the predictable cash flows and long-term power purchase agreements (PPAs) that characterize renewable energy projects.

When structuring project finance models, developers must carefully balance the cost of capital against risk exposure. Higher debt levels can enhance returns on equity but may also increase financial risk and reduce flexibility during operational challenges. To secure project financing, renewable energy developers typically need to demonstrate debt service coverage ratios (DSCR) of at least 1.2x to 1.4x, depending on the technology and market conditions.

Several factors influence the optimal debt-equity structure:

– Project technology maturity and operational track record

– Quality and creditworthiness of the PPA counterparty

– Regulatory environment and government incentives

– Construction and operational risks

– Interest rate environment and financing costs

Recent market trends show that utility-scale solar projects often achieve higher debt ratios (up to 85:15) compared to wind projects (typically 75:25) due to their lower operational complexity and more predictable output patterns. However, emerging technologies like battery storage may require higher equity contributions due to limited operational history and technology risk.

Lenders typically require a minimum equity contribution to ensure sponsor commitment and risk sharing. This equity component often comes from a combination of sponsor equity, tax equity investors, and sometimes mezzanine financing, creating a complex capital stack that must be carefully modeled to optimize returns while maintaining bankability.

Tax Incentives and Subsidies

Tax incentives and subsidies play a pivotal role in making renewable energy projects financially viable and attractive to investors. The Investment Tax Credit (ITC) and Production Tax Credit (PTC) remain the cornerstone incentives in many jurisdictions, offering significant reductions in project costs through tax savings. For solar projects, the ITC typically provides a 26% tax credit on qualified installation costs, while wind projects can benefit from the PTC based on power generation output.

Recent legislative developments, including the Inflation Reduction Act of 2022, have extended and enhanced these incentives, creating a more stable long-term environment for project planning. Project finance models must carefully incorporate these benefits, considering both their immediate impact on capital requirements and their long-term implications for project returns.

State-level incentives further complement federal programs, often through Renewable Portfolio Standards (RPS) requirements and associated Renewable Energy Credits (RECs). These mechanisms create additional revenue streams that must be accurately modeled, including potential price fluctuations and market dynamics.

Accelerated depreciation schemes, such as the Modified Accelerated Cost Recovery System (MACRS), allow projects to depreciate assets over shorter periods, improving early-year cash flows and overall project economics. Financial models should account for these depreciation benefits while considering their timing and impact on tax equity structures.

Property tax abatements and sales tax exemptions at the local level can also significantly reduce project costs. However, these incentives often require careful negotiation with local authorities and may come with specific performance requirements or community benefit obligations.

When modeling these incentives, analysts must consider:

– Qualification criteria and compliance requirements

– Timing of benefit realization

– Impact on capital structure and financing options

– Potential changes in incentive levels over the project lifecycle

– Alternative scenarios for incentive availability

– Integration with other financing mechanisms

Successful project finance modeling requires regular updates to reflect evolving incentive landscapes and policy changes, ensuring optimal utilization of available benefits while maintaining conservative assumptions for long-term viability.

Case Study: Successful Implementation

The Desert Sun Solar Project in California’s Mojave Desert stands as a compelling example of successful project finance modeling in renewable energy. Completed in 2021, this 500MW utility-scale solar installation demonstrates how sophisticated financial modeling can drive project success and attract diverse investment partners.

The project’s financial structure combined $450 million in senior debt, $150 million in tax equity investment, and $200 million in sponsor equity. The modeling team employed a detailed three-statement financial model with quarterly projections extending over the project’s 25-year power purchase agreement (PPA) term with the local utility.

Key success factors in the financial model included:

1. Accurate production forecasting using historical meteorological data and advanced solar irradiance modeling

2. Conservative degradation assumptions of 0.5% annually

3. Detailed operating cost projections incorporating preventive maintenance schedules

4. Comprehensive risk analysis covering weather variability, equipment failure, and grid curtailment

The model’s sensitivity analysis proved particularly valuable when negotiating with investors, demonstrating project viability across various scenarios. The base case projected an unlevered IRR of 8.5%, with upside potential reaching 10.2% under optimistic conditions.

Construction costs were carefully modeled using a detailed bottom-up approach, incorporating:

– Equipment costs with firm supplier commitments

– Labor costs based on local market rates

– Contingency allowances of 5% for known risks

– Insurance and performance bond costs

– Interconnection expenses

The project’s successful financial close was achieved within six months of initial modeling, with actual construction completed on schedule and 2% under budget. First-year energy production exceeded model projections by 3.5%, validating the conservative approach taken in the initial estimates.

A notable innovation in this case was the incorporation of battery storage facilities within the financial model, allowing for enhanced revenue optimization through time-shifting of energy delivery. This hybrid approach increased project returns by approximately 150 basis points compared to standalone solar generation.

The Desert Sun Project’s financial model has since become a template for similar utility-scale renewable developments, particularly in its treatment of:

– Tax equity structuring

– Production tax credit monetization

– Operating reserve requirements

– Debt service coverage ratios

– Insurance and warranty provisions

Actual operating results through the first 18 months have tracked within 5% of model projections across all major metrics, demonstrating the robustness of the financial modeling approach and providing valuable validation for future projects in the sector.

Project finance modeling for renewable energy projects continues to evolve as the industry matures and technology advances. The key takeaways from this analysis demonstrate that successful financial modeling requires a comprehensive understanding of multiple factors, including technical specifications, market dynamics, regulatory frameworks, and risk assessment methodologies.

As renewable energy projects become increasingly competitive with traditional power sources, accurate and sophisticated financial modeling becomes even more critical. The industry has witnessed a shift toward more complex hybrid projects and innovative financing structures, requiring models that can adapt to these new realities while maintaining reliability and precision.

Looking ahead, several trends will shape the future of project finance modeling in renewable energy. Machine learning and artificial intelligence are expected to play larger roles in optimizing financial models and improving forecasting accuracy. Additionally, the integration of environmental, social, and governance (ESG) metrics into financial models will become standard practice as investors and stakeholders demand greater transparency in sustainability metrics.

The standardization of modeling practices across the industry will likely continue, facilitating easier comparison between projects and streamlining due diligence processes. However, models must remain flexible enough to accommodate regional variations in regulations, incentives, and market conditions.

For construction professionals and project managers, staying current with these developments while maintaining fundamental modeling principles will be crucial. Success in renewable energy project finance will increasingly depend on the ability to balance sophisticated technical analysis with practical implementation strategies, all while adapting to rapid industry changes and emerging technologies.

The future outlook for renewable energy project finance remains robust, with continued innovation in both technology and financial structures driving the need for ever more sophisticated modeling approaches.