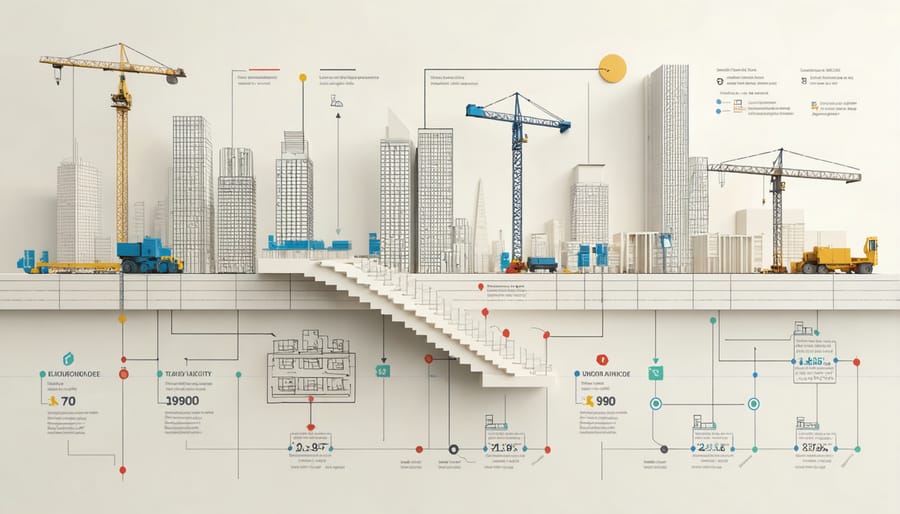

The four phases of construction represent critical milestones that determine project success and directly impact how developers secure financing for construction projects. From initial planning to final handover, each phase demands precise financial orchestration and milestone-based funding releases. Modern construction projects integrate advanced modeling technologies and risk management protocols across these phases, transforming traditional sequential workflows into dynamic, interconnected processes. Project success hinges on understanding how pre-construction planning, procurement, construction execution, and project closure align with capital deployment schedules and regulatory requirements. Industry leaders now leverage data-driven approaches to optimize phase transitions, reduce costly delays, and ensure seamless coordination among stakeholders. This systematic breakdown of construction phases provides a framework for both traditional and emerging project delivery methods, enabling professionals to navigate complex financing structures while maintaining operational efficiency.

Pre-Construction Phase Financing

Site Acquisition and Due Diligence Funding

Securing adequate funding for site acquisition and due diligence is crucial in laying the groundwork for successful construction projects. This initial phase requires careful financial planning and often involves multiple funding sources, including equity capital, traditional bank loans, and specialized real estate investment vehicles.

Project developers typically allocate 15-25% of the total project budget for land acquisition and preliminary assessments. The funding strategy must account for comprehensive due diligence activities, including environmental assessments, geotechnical surveys, and regulatory compliance reviews. Understanding these costs is essential for successful construction loan underwriting and securing favorable financing terms.

Common financing structures include land acquisition loans, bridge financing, and joint venture partnerships. These arrangements often require detailed feasibility studies and market analysis to demonstrate project viability to potential lenders and investors. Smart developers maintain contingency reserves of 10-15% during this phase to address unexpected findings from site investigations or regulatory requirements.

Risk mitigation strategies should include thorough title searches, zoning verification, and careful review of development restrictions. Many successful projects incorporate phased funding releases tied to specific due diligence milestones, ensuring capital efficiency while maintaining project momentum. This approach allows for strategic allocation of resources and helps prevent overextension during the critical early stages of development.

Design and Planning Capital Requirements

The design and planning phase requires significant upfront capital allocation, typically ranging from 6% to 12% of the total project budget. Professional service fees for architectural design and engineering consultations constitute the bulk of these initial expenses, with architectural fees commonly accounting for 3-7% of construction costs for new buildings and 5-12% for renovation projects.

Engineering costs vary based on project complexity and typically include structural, mechanical, electrical, and plumbing (MEP) engineering services. These expenses usually represent 2-5% of the total construction budget. Additional specialized engineering services, such as geotechnical surveys or environmental impact assessments, may increase these percentages.

Permit and compliance costs are another crucial consideration, varying significantly by jurisdiction and project scope. These expenses typically include building permits, environmental permits, zoning approvals, and impact fees. Setting aside 1-3% of the total budget for permitting and regulatory compliance is advisable.

Contingency planning is essential during this phase, with industry best practices recommending a 5-10% allocation for potential design changes or unforeseen requirements. Technology investments in Building Information Modeling (BIM) and other design software should also be factored into the budget, typically accounting for 0.5-1% of total costs.

Pre-construction services, including cost estimation, value engineering, and constructability reviews, usually require 1-2% of the project budget. These early-stage investments in thorough planning and design often result in significant cost savings during construction and reduced change orders.

Foundation Phase Financial Structure

Ground Works and Infrastructure Funding

Securing funding for groundworks and infrastructure represents a critical financial milestone in construction projects, typically requiring 20-30% of the total project budget. This phase demands careful financial planning due to its foundational nature and impact on subsequent construction stages.

Traditional financing methods include construction loans specifically earmarked for site preparation, with lenders typically requiring detailed geotechnical reports and environmental assessments before releasing funds. Many developers opt for a hybrid funding approach, combining institutional lending with private equity to manage cash flow during this capital-intensive phase.

Infrastructure funding often involves multiple stakeholders, including local authorities and utility companies. Public-private partnerships (PPPs) have emerged as an effective model for large-scale projects, enabling risk-sharing and access to government infrastructure grants. These arrangements typically cover essential services like road access, drainage systems, and utility connections.

Modern financing structures increasingly incorporate sustainability considerations, with green infrastructure bonds and environmental impact investments becoming popular funding sources. These instruments often offer preferential terms for projects implementing sustainable drainage systems and eco-friendly site preparation methods.

To mitigate financial risks, developers commonly establish contingency funds of 10-15% specifically for groundworks, acknowledging the unpredictable nature of subsurface conditions. Performance bonds and contractor warranties provide additional security, ensuring project continuity despite potential geological challenges or unexpected site conditions.

Risk Management and Insurance Requirements

Effective risk management and insurance coverage are crucial elements during foundation work and throughout the construction process. Implementing robust financial risk management strategies helps protect stakeholders against potential losses and ensures project continuity.

Key insurance requirements typically include builder’s risk insurance, general liability coverage, and professional liability insurance for design professionals. Contractors must also maintain workers’ compensation insurance and umbrella policies that provide additional protection beyond standard coverage limits.

Project-specific considerations should include specialized coverage for ground subsidence, water damage, and structural defects during foundation work. Performance bonds and payment bonds are essential to guarantee project completion and protect against contractor default.

Risk transfer mechanisms should be clearly defined in construction contracts, with careful attention to indemnification clauses and coverage requirements. Regular insurance audits and documentation reviews help ensure compliance with contractual obligations and regulatory requirements.

Modern construction projects often benefit from parametric insurance solutions that provide rapid payouts based on predefined triggers, such as severe weather events or material price fluctuations. This approach complements traditional coverage and enhances overall risk mitigation effectiveness.

It’s essential to review and update insurance coverage throughout the project lifecycle, particularly during critical foundation work phases when risks are heightened and exposure to potential losses is greatest.

Construction Phase Capital Management

Progressive Payment Structures

Progressive payment structures in construction projects are designed to align financial disbursements with project milestones and completion stages. These structures typically follow a predetermined schedule that mirrors the four construction phases, ensuring proper cash flow management and risk mitigation for all stakeholders.

During the pre-construction phase, payments usually cover design fees, permits, and preliminary site work, typically representing 10-15% of the total project cost. These initial payments enable contractors to mobilize resources and secure necessary materials without bearing excessive upfront costs.

The foundation phase typically triggers the second major payment milestone, accounting for 20-25% of the project budget. This payment structure acknowledges the significant material and labor investments required for groundwork, foundations, and primary structural elements.

The main construction phase often operates on a monthly draw schedule, with payments based on percentage completion verified through detailed progress reports and site inspections. This phase typically accounts for 50-60% of the total payment structure, with releases carefully tied to completed work packages and verified deliverables.

The final phase, including finishing work and project closeout, usually retains 5-10% of the total contract value. This retention serves as a performance guarantee and is typically released in two stages: partial release upon substantial completion and final release after the defect liability period expires.

Industry best practices recommend incorporating clear payment triggers, verification procedures, and dispute resolution mechanisms in the payment schedule. This systematic approach ensures project momentum while protecting the interests of both owners and contractors throughout the construction lifecycle.

Supply Chain Finance Integration

Supply chain finance integration has become a critical component in modern construction project management, particularly as material costs and labor expenses continue to fluctuate. Strategic financing approaches help maintain steady cash flow while ensuring timely delivery of materials and services throughout all construction phases.

Project managers are increasingly adopting dynamic financing models that align payment terms with material delivery schedules. This approach typically involves establishing relationships with multiple financial institutions to secure favorable terms for both short-term material purchases and long-term equipment investments. By implementing early payment programs with key suppliers, construction companies can often negotiate better pricing while maintaining healthy working capital.

The integration of digital payment platforms and supply chain management systems has revolutionized how construction firms handle material procurement. These systems enable real-time tracking of expenses, automated payment processing, and better forecasting of future financial needs. Many companies are now utilizing reverse factoring arrangements, where financial institutions pay suppliers early while extending payment terms for the construction firm.

Risk mitigation plays a crucial role in supply chain finance strategy. Construction firms are increasingly incorporating contingency funds specifically for material price fluctuations and implementing hedging strategies for commodities like steel and concrete. Some organizations are also exploring innovative solutions such as material banking and bulk purchasing agreements to secure better pricing and ensure availability.

Successful supply chain finance integration requires careful coordination between project managers, suppliers, and financial partners. Regular assessment of financing terms, supplier relationships, and market conditions helps maintain optimal cash flow while ensuring project timelines remain unaffected by supply chain disruptions.

Post-Construction Financial Considerations

Project Closeout Funding

Project closeout funding encompasses the final financial requirements needed to successfully complete and transfer a construction project. This critical phase typically requires 5-10% of the total project budget and includes several essential components. Retainage release, typically held at 5-10% throughout construction, forms a significant portion of closeout funding and is released upon satisfactory completion of all contractual obligations.

Final payment applications must account for any outstanding change orders, completion of punch list items, and resolution of any construction liens. Documentation requirements include warranties, as-built drawings, operations manuals, and certificates of occupancy, all of which may have associated costs that need funding allocation.

Financial considerations during closeout extend to commissioning activities, final inspections, and testing procedures. Project teams must also budget for training facility personnel, implementing maintenance programs, and addressing any deficiency corrections identified during final walkthrough.

Smart project managers maintain a separate closeout reserve fund throughout the project to ensure adequate resources for these requirements. This approach helps prevent delays in project completion and handover due to financial constraints. Industry best practices suggest establishing this reserve early in the project lifecycle, typically during the pre-construction phase, to ensure smooth project completion and transition to operations.

Long-term Financing Conversion

The final phase of construction involves a critical construction to permanent financing transition, marking the project’s evolution from active development to operational status. This transition typically occurs when the building reaches substantial completion and receives its certificate of occupancy. During this phase, developers work with financial institutions to convert short-term construction loans into long-term financing arrangements, often with more favorable interest rates and extended amortization periods.

Key requirements for successful conversion include meeting predetermined completion benchmarks, achieving minimum occupancy rates for commercial properties, and demonstrating stable cash flow projections. Lenders conduct thorough property inspections, review final construction documentation, and assess market conditions before approving the permanent financing structure.

Project teams must carefully coordinate with both construction and permanent lenders to ensure seamless timing of the conversion. This includes managing any prepayment penalties, addressing outstanding contractor liens, and completing all necessary property documentation. Early planning for this transition is essential, as permanent financing terms are often negotiated simultaneously with initial construction loans to secure optimal financial conditions and minimize conversion risks.

Understanding and aligning financing strategies with construction phases is crucial for project success in today’s dynamic construction landscape. As the industry evolves, phase-specific financing continues to gain importance, allowing for better risk management and resource allocation. Recent trends indicate a shift toward more flexible financing solutions, including digital payment platforms and sustainable building incentives. Project managers must stay informed about these emerging financial tools while maintaining a solid grasp of traditional phase-based funding mechanisms. Looking ahead, the integration of technology and sustainable practices will likely reshape phase-specific financing, potentially introducing new funding models tailored to modern construction methods. Success in future construction projects will depend on effectively matching financial strategies to each phase while adapting to industry innovations and regulatory changes.