Renewable energy deployment is accelerating at an unprecedented pace across the global construction sector, fundamentally reshaping how we power our built environment. Latest industry data reveals a 45% increase in renewable energy installations within commercial construction projects over the past two years, marking a decisive shift toward sustainable power solutions. As the future of renewable architecture unfolds, construction professionals are witnessing transformative changes in project specifications, building codes, and client demands.

This surge is driven by three key factors: rapidly declining installation costs (down 82% for solar PV since 2010), stringent environmental regulations mandating clean energy adoption, and growing corporate commitments to carbon neutrality. For construction industry stakeholders, this acceleration presents both opportunities and challenges, requiring new expertise in renewable technology integration and sustainable building practices.

Recent market analysis indicates that 75% of new commercial construction projects now incorporate some form of renewable energy system, representing a paradigm shift in how the industry approaches power generation and distribution in modern buildings.

Global Growth Metrics in Construction-Based Renewables

Market Growth Statistics

Recent market analysis reveals significant growth in renewable energy adoption across the construction sector, with a 34% increase in solar installations for commercial buildings in 2023 compared to the previous year. The International Energy Agency (IEA) reports that renewable energy integration in new construction projects has reached unprecedented levels, with 72% of new commercial developments incorporating at least one form of renewable energy system.

Statistical data from the Construction Industry Research Board shows that wind energy installations in commercial and industrial buildings have doubled since 2020, while geothermal system implementations have seen a 45% increase. The adoption rate of hybrid renewable systems, combining multiple clean energy sources, has grown by 56% in large-scale construction projects.

Energy-efficient building certifications linked to renewable energy usage have increased by 28% year-over-year, with LEED-certified projects showing particularly strong growth in the renewable energy category. Investment in renewable energy infrastructure within new construction projects has reached $89 billion globally, representing a 23% increase from 2022 levels. These figures demonstrate the construction industry’s accelerating shift toward sustainable energy solutions, driven by both regulatory requirements and economic benefits.

Regional Implementation Trends

Regional adoption of renewable energy shows distinct patterns across global markets, with Europe leading the transition through aggressive policy frameworks and substantial investments. The European Union has achieved remarkable integration rates, with countries like Germany and Denmark regularly meeting over 40% of their power demands through renewables.

Asia-Pacific demonstrates the fastest growth trajectory, primarily driven by China’s massive solar and wind energy installations. China alone accounts for nearly half of global renewable capacity additions in recent years, while India’s ambitious solar initiatives are rapidly transforming its energy landscape.

North America presents a mixed picture, with individual states showing varying levels of commitment. California leads U.S. implementation, consistently breaking records for solar integration, while Texas dominates in wind energy deployment. Canada focuses on expanding its already substantial hydroelectric capacity while developing wind resources.

Latin American markets are experiencing significant growth, particularly in Brazil and Chile, where favorable natural conditions and supportive policies drive implementation. The Middle East, traditionally dependent on fossil fuels, is pivoting toward solar energy, with the UAE and Saudi Arabia launching landmark renewable projects.

Africa shows promise in distributed solar solutions, though grid-scale implementation faces infrastructure challenges. However, countries like Morocco and South Africa are emerging as regional leaders in utility-scale renewable deployment.

Leading Renewable Technologies in Modern Construction

Solar Integration Advances

Building-integrated photovoltaics (BIPV) and solar thermal systems are experiencing unprecedented advancement in the construction sector. Recent innovations have enabled seamless integration of solar technologies into building materials, transforming traditional construction elements into energy-generating assets.

Modern BIPV solutions now include solar glass that maintains transparency while generating power, ideal for curtain walls and skylights. These systems achieve efficiency rates of up to 20%, while new thin-film technologies allow for flexible installation on curved surfaces. Construction firms are increasingly adopting solar roof tiles that match conventional roofing aesthetics while providing reliable power generation.

Solar thermal integration has evolved beyond basic water heating systems. Advanced vacuum tube collectors now achieve operating temperatures exceeding 200°C, making them suitable for both residential and industrial applications. Hybrid PV-thermal systems, which generate both electricity and heat, are showing promising results with combined efficiency rates of over 70%.

Notable developments include:

– Self-cleaning solar surfaces that maintain optimal performance

– Smart monitoring systems for real-time performance tracking

– Enhanced durability with 30+ year warranties

– Improved aesthetic integration options

– Reduced installation complexity and costs

These advancements are particularly significant in zero-energy building projects, where integrated solar solutions play a crucial role in achieving sustainability targets while maintaining architectural integrity. The market for integrated solar solutions is projected to grow by 15% annually through 2025, driven by improving technology and declining costs.

Geothermal Applications

The adoption of geothermal heating and cooling systems has seen remarkable growth in recent years, particularly in commercial and institutional construction projects. Industry data indicates a 15% year-over-year increase in geothermal installations across North America, with significant uptake in both new construction and retrofitting projects.

Leading construction firms report that ground-source heat pump technology has become increasingly cost-competitive, with installation costs declining by approximately 25% over the past five years. The long-term operational savings are particularly compelling, with buildings achieving 40-70% reduction in heating and cooling costs compared to conventional HVAC systems.

Recent innovations in drilling techniques and heat exchanger design have expanded the feasibility of geothermal installations in urban environments. Vertical bore systems now require smaller footprints, making them viable options for space-constrained projects. Additionally, hybrid systems that combine geothermal with other renewable technologies are gaining traction, offering enhanced efficiency and redundancy.

Several landmark projects showcase this trend, including the recently completed Stanford University campus expansion, which features North America’s largest ground-source heat pump system, demonstrating the scalability and reliability of geothermal solutions in institutional settings. The system is projected to reduce campus heating costs by 65% and cooling costs by 50%.

Wind Energy Solutions

Innovative building-integrated wind energy solutions are revolutionizing how structures harness and utilize renewable power. Recent advancements in wind turbine technology have enabled architects and engineers to incorporate these systems seamlessly into modern building designs, moving beyond traditional standalone wind farms.

Emerging solutions include helical wind turbines integrated into building facades, which can capture wind energy from multiple directions while maintaining aesthetic appeal. These systems are particularly effective in urban environments where wind patterns are affected by surrounding structures. Notable implementations include the Bahrain World Trade Center, which pioneered the use of bridge-mounted wind turbines between its twin towers, generating up to 15% of the building’s energy requirements.

Micro-wind turbines installed on rooftops are gaining traction, especially in commercial buildings. These compact units can be arranged in arrays to maximize energy capture while minimizing structural impact. Advanced computational fluid dynamics (CFD) modeling now allows designers to optimize turbine placement based on site-specific wind patterns and building aerodynamics.

Building-augmented wind technology (BAWT) represents another innovative approach, where building design itself enhances wind flow to turbines. This includes features like wind scoops, funnels, and aerodynamic shapes that accelerate wind speed at turbine locations, significantly improving energy generation efficiency.

These integrated solutions typically achieve payback periods of 5-8 years, making them increasingly attractive for sustainable building projects. However, successful implementation requires careful consideration of local wind resources, structural requirements, and maintenance accessibility.

Regulatory Landscape and Industry Standards

The regulatory landscape driving renewable energy adoption continues to evolve rapidly, with governments worldwide implementing increasingly stringent policies to accelerate the transition to clean energy. In the United States, the Inflation Reduction Act of 2022 represents a watershed moment, providing $369 billion in funding and tax incentives for renewable energy projects, marking the largest climate investment in U.S. history.

Key international frameworks, such as the Paris Agreement, have established binding targets for emissions reduction, compelling nations to develop comprehensive renewable energy policies. The European Union’s “Fit for 55” package aims to achieve a minimum 40% share of renewables in the total energy mix by 2030, setting ambitious benchmarks for member states.

Industry standards have also adapted to accommodate the surge in renewable energy implementation. The International Organization for Standardization (ISO) has developed specific guidelines, including ISO 50001 for energy management systems and ISO 14067 for carbon footprint measurement, which are increasingly becoming mandatory requirements for construction projects.

Building codes across major metropolitan areas now mandate minimum renewable energy requirements. For instance, California’s Title 24 energy code requires solar panels on new residential construction, while New York City’s Local Law 97 sets strict carbon emission limits for buildings, effectively pushing toward renewable energy adoption.

Professional certification programs, such as LEED and BREEAM, have strengthened their renewable energy prerequisites, making them essential considerations in modern construction projects. These standards now emphasize not only the installation of renewable energy systems but also their integration with smart building technologies and energy storage solutions.

Utility companies face renewable portfolio standards (RPS) requiring specific percentages of power generation from renewable sources. These mandates have created a robust market for power purchase agreements (PPAs) and renewable energy certificates (RECs), providing additional financial incentives for construction projects incorporating clean energy solutions.

Looking ahead, regulatory frameworks are expected to become more stringent, with many jurisdictions planning to implement zero-carbon building codes by 2030, making renewable energy integration an essential aspect of future construction planning and development.

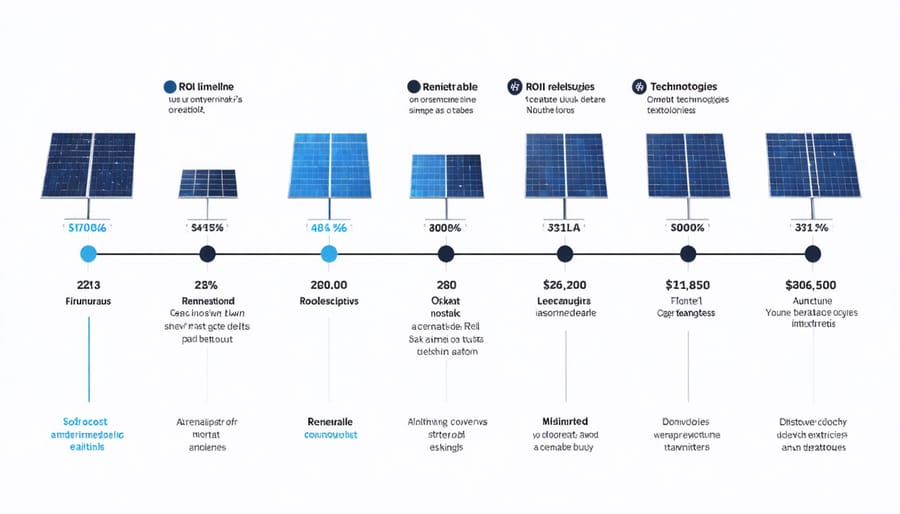

Economic Implications and ROI Analysis

Cost-Benefit Analysis

Initial capital investments in renewable energy systems remain significant, with solar installations averaging $2.50-$3.50 per watt for commercial projects and wind turbines requiring $1.3-$2.2 million per MW of capacity. However, ROI calculations demonstrate increasingly favorable economics. Solar installations typically achieve payback within 5-7 years, while wind projects average 7-10 years, depending on location and energy costs.

Operating costs have decreased dramatically, with maintenance expenses for solar systems averaging just $4-8 per kW annually. Modern wind turbines operate at $0.01-0.02 per kWh, significantly lower than traditional power sources. Implementation of cost-effective energy management strategies alongside renewable installations can further optimize returns.

Long-term benefits extend beyond direct energy savings. Properties with renewable energy systems command 7-10% higher market values, while qualifying for substantial tax incentives and depreciation benefits. Environmental compliance costs are reduced, and organizations gain resilience against volatile energy prices. When factoring in current federal incentives covering up to 30% of installation costs, the financial case for renewable energy adoption has never been stronger.

Investment Recovery Timeframes

Investment recovery periods for renewable energy systems vary significantly across different technologies and installation scales. Solar PV systems typically achieve payback within 5-7 years in optimal conditions, with commercial installations often recovering costs faster due to higher energy consumption offset. Recent technological improvements have reduced this timeframe from the previous 8-10 year average.

Wind energy installations demonstrate varying recovery periods based on location and scale. Utility-scale wind farms generally see returns within 7-10 years, while smaller commercial turbines may require 10-12 years. Coastal and high-altitude locations often achieve faster payback due to consistent wind patterns.

Geothermal systems, despite higher initial costs, typically recover investment within 5-10 years through significant reduction in heating and cooling expenses. Commercial buildings implementing geothermal technology report operational cost savings of 40-60% annually.

Biomass systems show diverse recovery periods, ranging from 3-7 years for industrial applications to 8-12 years for smaller commercial installations. The variance largely depends on fuel availability and local energy costs.

Modern energy storage solutions, while adding to initial costs, can reduce overall payback periods by 15-20% through improved energy management and peak load reduction. This integration has become increasingly crucial for optimizing renewable energy investments in commercial construction projects.

The evidence is clear: renewable energy adoption in construction continues to accelerate at an unprecedented pace. Market analysis indicates that sustainable building practices incorporating renewable energy systems are no longer just an environmental choice but a sound business decision. Construction firms that have embraced renewable technologies report significant long-term cost savings and enhanced project value propositions.

Looking ahead, industry experts project continued growth in renewable energy integration across all construction sectors. Emerging technologies, particularly in solar and energy storage solutions, are becoming more efficient and cost-effective. The convergence of smart building systems with renewable energy infrastructure is creating new opportunities for innovative construction approaches.

However, successful implementation requires careful planning and expertise. Construction professionals must stay informed about evolving regulations, financing options, and technical requirements. The industry’s shift toward renewables demands ongoing education and adaptation of traditional construction methods.

The future outlook is promising, with renewable energy becoming increasingly central to construction projects worldwide. Market trends suggest that buildings incorporating renewable energy systems will become the standard rather than the exception. Construction firms that develop expertise in renewable energy integration now will be well-positioned to meet growing client demands and regulatory requirements.

For construction professionals, the message is clear: renewable energy adoption is not just increasing – it’s transforming the industry’s fundamental approach to building design and execution.