The United States stands at the forefront of a transformative expansion in liquefied natural gas (LNG) infrastructure, with over 20 export terminals currently under construction across strategic coastal locations. These multibillion-dollar projects, representing more than 250 million tonnes per annum (MTPA) of additional capacity, are reshaping the global energy landscape and reinforcing America’s position as a dominant LNG exporter.

As construction teams navigate complex regulatory requirements and technical challenges, these terminals incorporate cutting-edge technologies in cryogenic storage, liquefaction processes, and marine loading systems. The projects, ranging from brownfield expansions to greenfield developments, showcase advanced engineering solutions while addressing critical environmental and safety standards mandated by the Federal Energy Regulatory Commission (FERC) and Department of Energy (DOE).

Industry leaders and construction professionals are particularly focused on innovative approaches to modular construction, accelerated project timelines, and enhanced safety protocols. These developments come at a crucial time when global demand for LNG continues to surge, driven by energy security concerns and the transition toward cleaner fuel sources. Understanding the scope, challenges, and opportunities within these construction projects is essential for stakeholders across the energy and construction sectors.

Current LNG Terminal Construction Projects

Gulf Coast Expansion Projects

The Gulf Coast region continues to dominate U.S. LNG export terminal construction, with several major projects currently underway. In Cameron Parish, Louisiana, the Calcasieu Pass 2 project represents one of the largest expansions, featuring 18 mid-scale modular liquefaction trains with a combined capacity of 20 million tonnes per annum (MTPA). The project employs innovative modular construction techniques to reduce on-site assembly time and overall project costs.

In Texas, the Port Arthur LNG facility’s Phase 1 construction encompasses two liquefaction trains, with a planned capacity of 13.5 MTPA. The project incorporates advanced automation systems and state-of-the-art safety features, setting new industry standards for operational efficiency. Nearby, the Golden Pass LNG Terminal conversion project continues to progress, utilizing existing infrastructure while adding three new liquefaction trains.

Corpus Christi’s Stage 3 expansion represents another significant development, adding seven mid-scale trains to increase the facility’s capacity by 10 MTPA. The project implements advanced air cooling systems specifically designed for the Gulf Coast’s humid climate conditions.

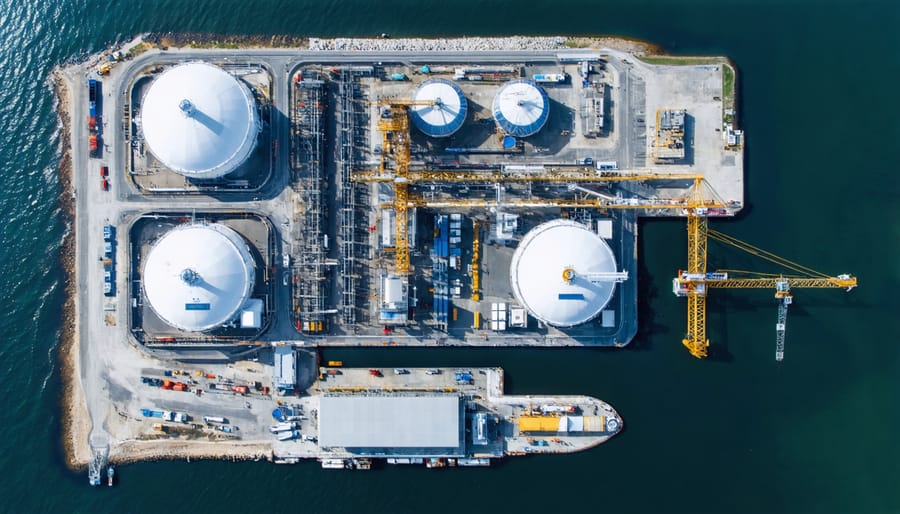

The Plaquemines LNG Terminal in Louisiana showcases innovative engineering solutions for coastal construction, including elevated platforms and reinforced foundation systems to address subsidence concerns. The project’s first phase includes six liquefaction trains and two LNG storage tanks.

These Gulf Coast projects collectively represent over $40 billion in capital investment and will significantly boost U.S. LNG export capacity by 2025. Construction teams are implementing lessons learned from previous projects, particularly regarding weather resilience and environmental protection measures, while maintaining strict adherence to federal safety regulations and local building codes.

East Coast Developments

Along the Atlantic seaboard, several major LNG export terminals are reshaping the energy infrastructure landscape. The Elba Island LNG facility in Georgia continues its expansion, with six of ten planned modular liquefaction units now operational. Each unit adds approximately 0.3 million tonnes per annum (MTPA) to the facility’s export capacity.

In Maryland, the Cove Point LNG Terminal has completed its brownfield conversion project, transforming from an import-only facility to a bidirectional terminal capable of both import and export operations. The facility now processes approximately 5.25 MTPA of LNG, utilizing advanced liquefaction technology and upgraded marine berthing facilities.

Jacksonville’s Eagle LNG project in Florida represents a new generation of small-scale LNG facilities, designed specifically for Caribbean market distribution. The facility, currently under construction, will feature three liquefaction trains with a combined capacity of 1.65 MTPA.

These East Coast developments strategically position the United States to serve European markets, with shorter shipping routes providing competitive advantages over Gulf Coast terminals. Construction timelines remain on track despite supply chain challenges, with most projects maintaining their scheduled completion dates.

Regulatory Framework and Compliance

Federal Construction Requirements

The Federal Energy Regulatory Commission (FERC) maintains stringent oversight of LNG export terminal construction, establishing comprehensive requirements that align with recent industry regulatory shifts. These standards encompass critical safety measures, environmental protection protocols, and technical specifications that must be meticulously followed throughout the construction process.

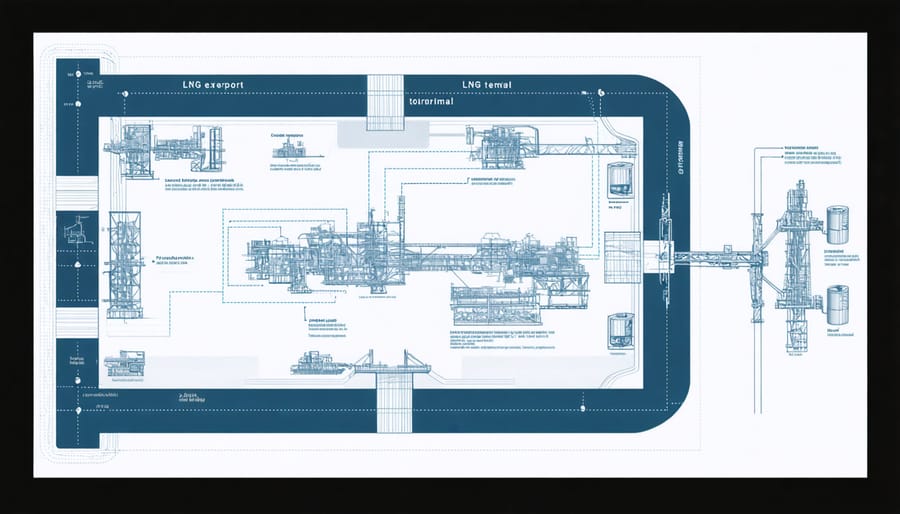

Key FERC requirements include robust containment systems for LNG storage, specialized vapor handling equipment, and advanced fire protection infrastructure. Construction teams must implement seismic design considerations, ensuring terminals can withstand natural disasters and maintain structural integrity under extreme conditions. The commission mandates detailed documentation of quality control procedures, material specifications, and welding protocols.

Environmental compliance forms a significant component of federal requirements, necessitating proper erosion control, wildlife protection measures, and air quality monitoring during construction. Contractors must maintain comprehensive environmental management plans and conduct regular assessments throughout the building phase.

Safety protocols demand specialized training for construction personnel, implementation of emergency response systems, and installation of sophisticated monitoring equipment. FERC regulations require regular safety audits, with particular attention to cryogenic protection systems and pressure vessel installations.

Construction teams must also adhere to specific timeline requirements, submitting detailed progress reports and undergoing periodic FERC inspections. These requirements ensure project milestones align with federal safety standards and operational readiness criteria, ultimately facilitating a smooth transition from construction to operational status.

International Trade Compliance

U.S. LNG export terminals must comply with stringent federal regulations and global trade regulations before commencing operations. The Department of Energy (DOE) requires facilities to obtain both Free Trade Agreement (FTA) and non-FTA export authorizations, while the Federal Energy Regulatory Commission (FERC) oversees the siting, construction, and operation of these terminals.

Export terminals must also adhere to the Natural Gas Act (NGA) requirements, which mandate extensive environmental reviews and safety assessments. The Maritime Transportation Security Act (MTSA) imposes additional security protocols for waterfront facilities handling LNG shipments.

International trade agreements significantly influence terminal operations. The U.S.-EU Energy Security Partnership has accelerated LNG export capabilities to European markets, while agreements with Asian nations have established long-term supply commitments. These arrangements often require terminals to maintain specific operational standards and meet rigorous quality control measures.

Compliance documentation includes detailed Environmental Impact Statements (EIS), safety and security plans, and emergency response procedures. Terminal operators must regularly update these documents and undergo periodic compliance audits. Recent regulatory changes have introduced enhanced cybersecurity requirements and stricter emissions monitoring protocols.

Construction companies must ensure their terminal designs incorporate features that facilitate customs inspections, vessel screening, and product verification. This includes specialized measurement systems, custody transfer points, and security infrastructure that meets both domestic and international standards. Regular consultation with regulatory bodies during construction helps prevent costly compliance issues post-completion.

Construction Challenges and Solutions

Technical Infrastructure Requirements

LNG export terminals require sophisticated engineering and construction infrastructure to ensure safe, efficient operations. These facilities must withstand extreme temperature variations while maintaining stringent quality control standards throughout their operational lifecycle.

The foundation systems demand specialized designs incorporating thick reinforced concrete pads capable of supporting massive storage tanks and processing equipment. These foundations must account for soil conditions, seismic requirements, and potential settlement issues. Cryogenic containment systems, including double-walled storage tanks with sophisticated insulation, are essential for maintaining LNG at approximately -162°C (-260°F).

Critical infrastructure components include liquefaction trains, consisting of heat exchangers, compressors, and cooling systems. Marine terminals require deep-water berths with specialized loading arms, cryogenic piping systems, and advanced mooring facilities designed for LNG carriers. Emergency systems, including fire suppression infrastructure, gas detection networks, and containment measures, must be integrated throughout the facility.

Construction materials must meet specific requirements for low-temperature service, including specialized steel grades, insulation materials, and sealing systems. The electrical and control systems require redundant power supplies, sophisticated automation platforms, and fail-safe emergency shutdown capabilities to ensure continuous safe operation.

Supply Chain Management

The construction of LNG export terminals demands a sophisticated approach to material procurement and logistics management. Contractors must navigate complex supply chains involving specialized equipment, cryogenic materials, and precision-engineered components. Critical elements include large-scale storage tanks, liquefaction trains, and marine loading arms, all requiring careful coordination with global suppliers.

Effective supply chain management compliance is essential, particularly given the stringent quality requirements for LNG facility components. Project managers must maintain detailed documentation of material sources, quality certifications, and transportation records to meet regulatory standards.

Current market conditions have intensified the importance of strategic procurement planning. Lead times for critical equipment can extend beyond 24 months, necessitating early engagement with suppliers and manufacturers. Contractors are implementing advanced inventory management systems and establishing redundant supply networks to mitigate potential disruptions.

Local sourcing initiatives have gained prominence, with contractors developing relationships with domestic manufacturers where possible. This approach helps reduce transportation costs and delivery times while supporting project timelines. Additionally, port facilities near construction sites are being upgraded to handle oversized cargo and specialized equipment, ensuring smooth logistics operations throughout the construction phase.

Economic Impact and Market Outlook

Investment and Employment

The construction of LNG export terminals represents a significant economic catalyst for the U.S. economy, generating substantial employment opportunities and attracting massive capital investment. Current projects under construction are estimated to bring over $100 billion in direct investment to coastal regions, with individual terminals typically requiring $8-15 billion in capital expenditure.

These developments create multiple tiers of employment opportunities. During the construction phase, each major terminal project generates 3,000-5,000 direct construction jobs, including specialized roles for welders, pipefitters, electrical technicians, and heavy equipment operators. The peak construction period typically spans 3-4 years, providing sustained employment for local communities.

Beyond direct construction jobs, these projects create an estimated 15,000-20,000 indirect jobs throughout the supply chain, including manufacturing, transportation, and professional services. Once operational, each terminal maintains 200-300 permanent positions, predominantly in technical and engineering roles.

The economic impact extends beyond employment figures. Local businesses benefit from increased activity, while municipalities receive expanded tax revenues. According to industry analyses, LNG terminal construction projects contribute approximately $1.5-2.5 billion annually to regional economies through wages, local procurement, and auxiliary services.

Training programs and partnerships with local technical schools have emerged to prepare the workforce for both construction and operational phases, ensuring sustainable long-term employment opportunities in these communities.

Future Market Projections

Market analysts project that U.S. LNG export capacity will reach approximately 24.3 billion cubic feet per day (Bcf/d) by 2027, representing a substantial increase from current levels. This expansion is primarily driven by strong demand from European markets seeking to diversify their energy sources and growing Asian economies requiring cleaner energy alternatives.

Industry experts anticipate that U.S. LNG exports will capture approximately 25% of the global LNG market share by 2025, positioning the United States as one of the world’s leading LNG exporters alongside Qatar and Australia. The completion of terminals currently under construction is expected to generate an additional $15-20 billion in annual export revenue.

European demand is projected to remain robust through 2030, with long-term contracts already securing significant portions of future production capacity. Asian markets, particularly China, Japan, and South Korea, are expected to maintain steady growth in LNG imports, creating a balanced demand portfolio for U.S. exporters.

The expanding export capacity is also anticipated to strengthen America’s energy diplomacy and trade relationships. However, market analysts caution that increased competition from emerging LNG exporters and potential shifts in global energy policies could impact long-term pricing dynamics. Despite these considerations, the fundamental outlook for U.S. LNG exports remains strong, supported by established infrastructure and competitive production costs.

The ongoing expansion of U.S. LNG export terminal construction represents a significant transformation in global energy infrastructure. With seven major terminals currently under construction and numerous others in various planning stages, the United States is positioned to become the world’s leading LNG exporter by 2025. These projects, collectively valued at over $50 billion, will add approximately 20 billion cubic feet per day of export capacity upon completion.

The successful execution of these complex projects, despite challenges in supply chain management and regulatory compliance, demonstrates the industry’s resilience and technological advancement. As global demand for cleaner energy sources continues to rise, particularly in Europe and Asia, these terminals will play a crucial role in energy security and trade relationships. Construction professionals should anticipate continued growth in this sector, with opportunities for innovation in construction methods, sustainability practices, and project management approaches.